S Corp vs. Sole Proprietorship Taxes: Explaining the Differences

Let’s get down to the business of starting a business. There’s much to consider before launching a new business, including how it’s structured. To get started, we’ll look at S corp vs. sole proprietorship and what makes them different.

What’s a sole proprietorship?

Basically, a sole proprietorship is owned and operated by you—the sole owner. In a way, this is business at its simplest. You are a self-employed business owner. All business assets belong to you. You make all the business decisions.

On the other hand is the big risk. You may be solely responsible for any damages caused by negligence. With sole proprietorship, there is generally no personal liability protection. If you decide sole proprietorship is best for you, you might want to consider liability insurance.

What’s an S corp?

A sole proprietorship can be organized as an S corporation with a sole owner. However, you would be considered a shareholder. But with sole ownership, you would still act as the president, executive and business manager.

The main difference between an S corp and sole proprietorship is the limited liability protection for shareholders. (There can be up to 100 shareholders; limited to individuals) Generally, shareholders are not responsible for corporate debts.

However, there are loopholes. That is one among many reasonswhy working with a team of experts who are familiar with the ins and outs of setting up a business is a good idea.

At Todd Greene, C.P.A., we start with listening to your needs. Then we offer guidance, answer your questions and work together to create what’s best for you and your business.

Tax time

In terms of taxes and S corp vs. sole proprietorship, think of it this way. As an S corp, the business owner pays FICA and income taxes on a “reasonable salary” and income taxes on distribution.

With a sole proprietorship, the business owner pays self-employment taxes and income taxes on the net profit of the business. Sole proprietor tax reporting is more streamlined and simpler.

Another important point is that LLCs can be taxed as either S corps or sole proprietorships.

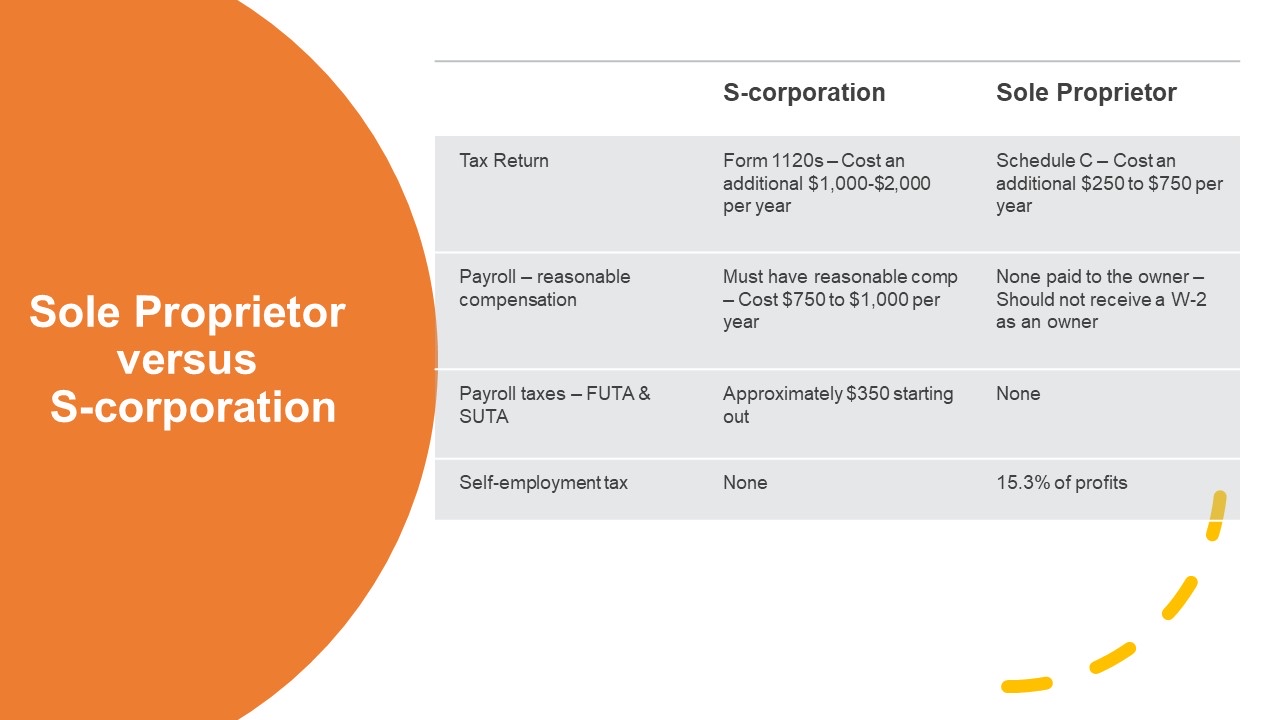

Below is a table comparing the two in a basic scenario to help clarify the tax differences between them.

Summary

When it comes to S corp vs. sole proprietorship, this is just the tip of the iceberg. If you are ready to discuss the details, we are ready to listen. It starts with a free consultation. Keep reading our blogs for more money matters, tax planning and other financial information for businesses and high net worth individuals.